Promotional financing is a powerful marketing strategy that boosts sales by offering flexible payment options or discounts, attracting new customers and increasing revenue across sectors. To maximize return on investment (ROI), businesses should implement data-driven approaches using analytics tools to track conversions and consumer behavior in real-time. Integrating advanced metrics and streamlining assessment efficiency allows for informed adjustments to future campaigns, ensuring optimal ROI from promotional financing initiatives.

In today’s competitive market, understanding the return on investment (ROI) from promotional financing campaigns is crucial for businesses. Promotional financing, a strategic tool to boost sales and customer engagement, requires precise measurement to ensure its effectiveness. This article delves into the intricacies of assessing ROI from such campaigns, offering insights on strategies, tools, and metrics to enhance assessment efficiency and maximize promotional financing’s impact. By understanding these techniques, businesses can make informed decisions and optimize their marketing efforts.

- Understanding Promotional Financing and Its Impact

- Strategies for Accurate ROI Measurement

- Tools and Metrics to Enhance Assessment Efficiency

Understanding Promotional Financing and Its Impact

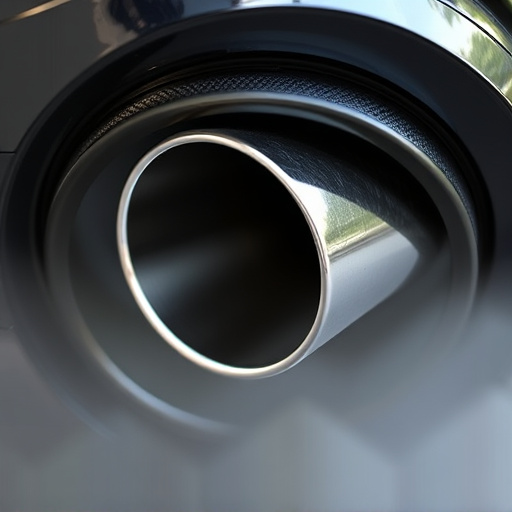

Promotional financing is a powerful tool that businesses utilize to stimulate sales and enhance customer engagement during marketing campaigns. It involves offering customers flexible payment options or discounts with specific terms, encouraging purchases of products or services. This strategy has gained significant traction in various industries, from automotive deals on vehicle protection plans and vehicle wraps to retail promotions featuring high-quality finishes on home decor items.

By implementing promotional financing, businesses can attract a wider customer base and increase sales volumes. For instance, offering 0% financing for a limited time on car accessories or auto repairs can draw in customers looking to enhance their vehicles with protection packages or visually appealing vehicle wraps. This approach not only boosts immediate revenue but also fosters long-term relationships with clients who appreciate the added value and convenience of these financial incentives.

Strategies for Accurate ROI Measurement

Measuring the return on investment (ROI) from promotional financing campaigns accurately is paramount for businesses to understand the effectiveness and value of their marketing efforts. A robust strategy involves several key components. First, clearly define campaign goals and metrics; this could include sales lift, brand awareness, or customer acquisition cost reduction. By setting specific, measurable objectives, you provide a solid framework for evaluating success.

Second, integrate professional ppf installation into your promotional mix, leveraging custom vehicle wraps with UV protection as a dynamic marketing tool. These tactics not only enhance the visual appeal of assets but also serve as mobile billboards, promoting your brand to a broader audience. Tracking conversions and attributing them to specific campaigns allows for precise ROI calculation. Additionally, utilizing analytics tools that provide detailed insights into consumer behavior and engagement can offer valuable data points for optimization and future planning.

Tools and Metrics to Enhance Assessment Efficiency

To accurately measure the return on investment (ROI) from promotional financing campaigns, businesses should leverage advanced tools and metrics that streamline assessment efficiency. These include data analytics platforms capable of integrating diverse marketing channels and tracking consumer behavior in real-time. By analyzing data points such as click-through rates, conversion rates, and customer engagement, companies can gain invaluable insights into the performance of their promotional initiatives.

Furthermore, considering unique aspects of promotional financing like heat rejection from custom vehicle wraps with UV protection can offer additional metrics. For instance, tracking the number of eyeballs reached through these wrapped vehicles and measuring subsequent interest or sales generated provides a granular understanding of promotional financing’s direct and indirect impacts on brand visibility and revenue. Such comprehensive assessments enable data-driven adjustments to future campaigns, ensuring optimal ROI.

Accurately measuring the return on investment (ROI) from promotional financing campaigns is essential for businesses to understand the true impact of these strategies. By employing effective measurement techniques, tools, and metrics discussed in this article, companies can gain insightful knowledge about their promotional financing initiatives’ performance. This understanding enables data-driven decisions, optimizes marketing spend, and ultimately drives business growth through strategic promotional financing.