Promotional financing is a powerful tool for automotive businesses to attract high-value buyers by offering flexible, low-interest payment plans for services like car customization. This strategy taps into people's preference for instant gratification, making premium treatments more accessible and fostering positive brand associations. To maximize its impact, businesses should align promotions with product features, partner with installation services, and employ clear marketing strategies, ultimately driving immediate customer action and encouraging repeat purchases.

Promotional financing, a powerful tool in retail and e-commerce, instantly captivates buyers with its attractive offers. This strategy goes beyond traditional marketing, providing immediate benefits that drive sales. In this article, we explore ‘Understanding Promotional Financing: Unlocking Instant Buyer Appeal’ to unravel the psychology behind its effectiveness. We also delve into ‘Strategies for Effective Implementation’ to help businesses maximize the advantages of promotional financing, ensuring a competitive edge in today’s market. Discover how this approach can revolutionize your sales strategy.

- Understanding Promotional Financing: Unlocking Instant Buyer Appeal

- The Psychology Behind Instant Attraction: Why It Works

- Strategies for Effective Implementation: Maximizing Promotional Financing Benefits

Understanding Promotional Financing: Unlocking Instant Buyer Appeal

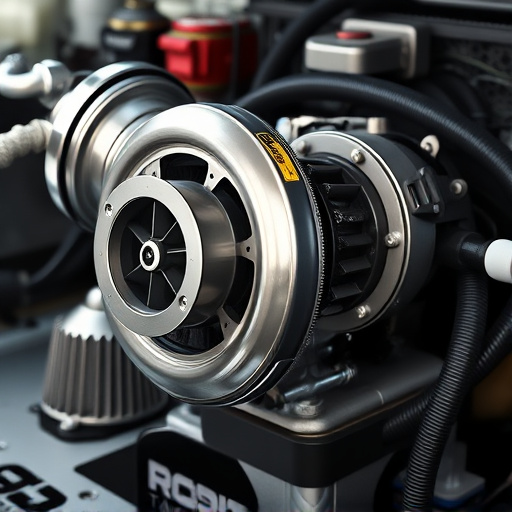

Promotional financing is a powerful tool that can instantly boost buyer interest. It refers to special offers and flexible payment plans designed to make high-value purchases more accessible and appealing, especially for significant investments like car customization or premium automotive services. By spreading out the cost over time with low-interest rates or even zero-interest options, promotional financing removes a major barrier to entry for potential buyers.

This strategy is particularly effective because it caters to various buyer personas and their unique financial circumstances. For some, the ability to afford top-tier products like scratch protection for cars through promotional financing means the difference between owning a vehicle they truly desire and settling for something less. It empowers individuals to access premium automotive services without the immediate financial strain, allowing them to enjoy enhanced vehicles right away while planning for future repayment on their terms.

The Psychology Behind Instant Attraction: Why It Works

The psychology behind consumer behavior is a fascinating field, and when it comes to promotional financing, it’s clear that this strategy taps into our innate desires for instant gratification. When buyers are presented with the opportunity to access premium automotive services or indulge in paint correction treatments at attractive financial terms, it triggers a powerful response. The concept of “now” becomes a compelling factor; acquiring something desirable immediately outweighs the potential long-term benefits of saving up.

This phenomenon can be attributed to our brain’s preference for instant rewards over delayed gratification. Promotional financing offers an appealing solution to the age-old dilemma, allowing buyers to access high-quality services like automotive detailing without breaking the bank. The use of such financing strategies not only satisfies our desire for immediate satisfaction but also builds a positive association with the brand, encouraging repeat purchases and fostering long-term customer loyalty.

Strategies for Effective Implementation: Maximizing Promotional Financing Benefits

To maximize the benefits of promotional financing and attract more buyers instantly, businesses must employ strategic implementation tactics. Firstly, offering flexible payment plans can significantly enhance accessibility for prospective customers. This approach ensures that potential buyers are not deterred by upfront costs but instead encouraged to take advantage of the promotion. Secondly, aligning promotional financing with specific product or service features can create a sense of urgency and exclusivity. For instance, bundling promotional offers with vehicle protection packages or protective coatings can entice buyers who value long-term investment in their purchases.

Additionally, partnering with professional installation services for features like protective coatings (Professional PPF Installation) demonstrates commitment to quality and aftercare. This not only bolsters buyer confidence but also ensures that the promotional financing benefits are fully realized. Effective communication strategies, such as clear marketing materials and personalized outreach, further reinforce these advantages, ultimately driving more buyers towards immediate action.

Promotional financing is a powerful tool that can significantly boost sales and attract more buyers instantly. By offering flexible payment options and incentives, businesses create an appealing shopping experience that taps into consumers’ psychological desires. Implementing these strategies effectively not only drives immediate sales but also fosters long-term customer loyalty. With the right approach, promotional financing can be a game-changer in today’s competitive market, ensuring businesses stay ahead and meet their buyers’ needs.