Promotional financing boosts customer satisfaction and conversions by offering flexible payment options for premium services like car coatings and window tinting. Strategies such as interest-free financing and split-payment plans attract diverse buyer personas, drive rapid conversions, and foster client loyalty, leading to higher retention rates across various industries.

Promotional financing is a powerful tool that can significantly boost customer conversions. By offering flexible payment options and incentives, businesses can unlock unprecedented purchasing power and attract new customers. This article delves into the concept of promotional financing, explores effective strategies for implementation, and presents inspiring case studies showcasing its impact. Discover how this approach can revolutionize your sales strategy and drive fast, sustainable growth.

- Understanding Promotional Financing: Unlocking Customer Potential

- Strategies to Implement Promo Finance for Swift Conversions

- Case Studies: Success Stories of Promotional Financing

Understanding Promotional Financing: Unlocking Customer Potential

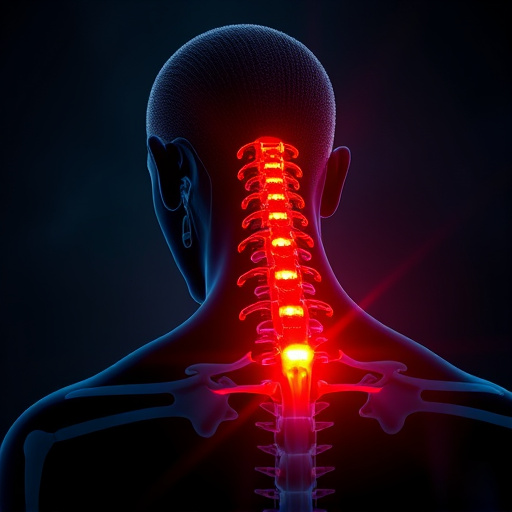

Promotional financing is a powerful tool that recognizes the inherent value of customers and their purchasing potential. It goes beyond traditional lending by offering flexible payment options tailored to suit various consumer needs. By implementing this strategy, businesses unlock a new level of accessibility, making premium services, such as ceramic coatings or vinyl wraps, more attainable for potential clients.

This approach not only boosts customer satisfaction but also accelerates conversion rates. With promotional financing, consumers can access high-quality services like those offered in the automotive industry without the immediate financial burden. This strategy creates a win-win situation where customers gain access to premium automotive services they desire, and businesses see an increase in sales, fostering long-term relationships with their clientele.

Strategies to Implement Promo Finance for Swift Conversions

Implementing promotional financing strategies effectively can significantly boost customer conversions in a short time. One proven approach is offering flexible payment plans that cater to various buyer personas and their financial comfort levels. For instance, split-payment options allow customers to make substantial purchases, like car customization packages or high-quality paint protection film installations, by spreading the cost over several months. This accessibility enhances customer satisfaction and increases the likelihood of conversions.

Additionally, leveraging promotional financing as an incentive during special sales events can drive rapid conversions. Discounts combined with interest-free financing for a limited period create a compelling offer that resonates with customers seeking value. By integrating these strategies, businesses not only attract more clients but also foster loyalty by demonstrating their commitment to providing accessible and affordable high-quality finishes.

Case Studies: Success Stories of Promotional Financing

Promotional financing has proven to be a powerful tool for businesses across various industries, and its impact on customer conversions is well-documented through numerous case studies. For instance, automotive detailing shops have witnessed significant growth by offering promotional financing options to their clients. By allowing customers to spread out the cost of services like window tinting or paint correction over an extended period, these businesses attract a wider range of clients who might otherwise be deterred by the upfront price tag.

This strategy has also been successful in the window tinting industry, where high-quality services can be expensive. By implementing promotional financing plans, many window tinting companies have seen a surge in customer retention and repeat business. Similarly, paint correction services, which often require significant investment for top-tier equipment and skilled technicians, benefit from promotional financing as it enables customers to access these premium services without the immediate financial burden, leading to higher conversion rates.

Promotional financing is a powerful tool that can significantly boost customer conversions and drive business growth. By understanding the dynamics of this strategy, implementing tailored tactics, and learning from real-world case studies, businesses can unlock new levels of success. Promotional financing isn’t just about offering discounts; it’s an art of incentivizing customers to take action, fostering a win-win situation where buyers enjoy exclusive benefits and retailers see increased sales. Embrace these insights and leverage promotional financing to fast-track your customer conversion rates.