Promotional financing is a strategic tool for businesses to differentiate themselves and attract customers by offering tailored financial incentives, such as exclusive service packages combined with deferred payments or low-interest rates in the automotive sector. Unlike standard credit cards, these structured promotions provide specific advantages for targeted purchases like cars and appliances, including unique perks like window tinting services. In a competitive market, businesses can stand out by integrating advanced services like ceramic window tinting into promotional financing plans, appealing to diverse customer segments with eco-friendly benefits and long-term solutions.

Promotional financing is a powerful tool for businesses aiming to boost sales and attract customers. In a competitive market, understanding how promotional financing stacks up against established credit card offers is key. This article delves into the world of promotional financing, exploring its unique benefits, comparing it to traditional credit card incentives, and providing strategic insights to help businesses implement effective financing plans that keep pace with the ever-evolving consumer landscape. Discover how tailored promotional financing can drive growth and enhance customer satisfaction.

- Understanding Promotional Financing: Unlocking Benefits and Opportunities

- Comparing with Credit Card Offers: What Sets Promotional Financing Apart?

- Implementing Effective Strategies: Attracting Customers Through Competitive Financing

Understanding Promotional Financing: Unlocking Benefits and Opportunities

Promotional financing is a powerful tool that offers businesses an alternative to traditional credit card offers, providing a fresh perspective on customer incentives. It involves structured financial promotions designed to attract and retain customers by offering them unique benefits, such as deferred payment or low-interest rates, for specific purchases. This approach goes beyond the conventional credit card model, allowing companies to compete effectively in a crowded market.

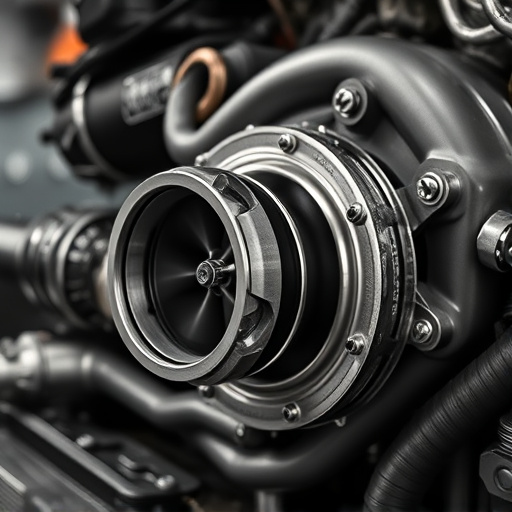

For businesses catering to automotive enthusiasts, promotional financing can be a game-changer. Consider offering special packages that include premium automotive services like paint correction with high-quality finishes. By structuring these promotions, businesses can target specific customer segments, attract new clients, and foster loyalty among existing ones. This strategy not only enhances the overall customer experience but also provides an opportunity to stand out in a competitive market, ultimately driving business growth.

Comparing with Credit Card Offers: What Sets Promotional Financing Apart?

When considering promotional financing options, it’s important to understand how they differ from standard credit card offers. While credit cards often come with enticing rewards and cash back benefits, promotional financing is designed for specific purchases and can offer unique advantages tailored to those needs. For instance, in industries like automotive or home improvement, promotional financing may provide lower interest rates or no-interest periods for qualified purchases, such as new cars or major appliances—a significant difference from the variable interest rates typically associated with credit cards.

Moreover, promotional financing often comes bundled with additional perks not commonly found on credit cards. These can include UV protection for car windows through tinting services or scratch protection for new devices, adding a layer of extra value to the transaction. Such offers cater to specific customer needs and preferences, making promotional financing an attractive alternative that goes beyond the universal appeal of cash back or points rewards.

Implementing Effective Strategies: Attracting Customers Through Competitive Financing

In today’s competitive market, businesses must go beyond traditional credit card offers to attract and retain customers. Implementing effective promotional financing strategies is key to standing out from the crowd. One powerful tool is offering ceramic window tinting services as part of their promotions, not only enhancing vehicle aesthetics but also providing significant heat rejection benefits. By combining this with promotional financing, businesses create a compelling offer that appeals to environmentally conscious consumers and those seeking cost savings on energy bills.

Additionally, applying ceramic coatings can further elevate the value proposition. This advanced protective layer not only adds a glossy finish but also reduces the need for frequent detailing, making it an attractive option for customers looking for long-term solutions. By integrating these innovative services into promotional financing plans, businesses can attract a wider customer base and foster loyalty through competitive offers that go beyond traditional credit card perks.

Promotional financing offers businesses a powerful tool to enhance customer experience and drive sales. By understanding its unique benefits and implementing strategic approaches, companies can create competitive offers that rival credit card incentives. This tailored financing not only attracts customers but also fosters loyalty and encourages repeat business, making it an indispensable strategy in today’s market.